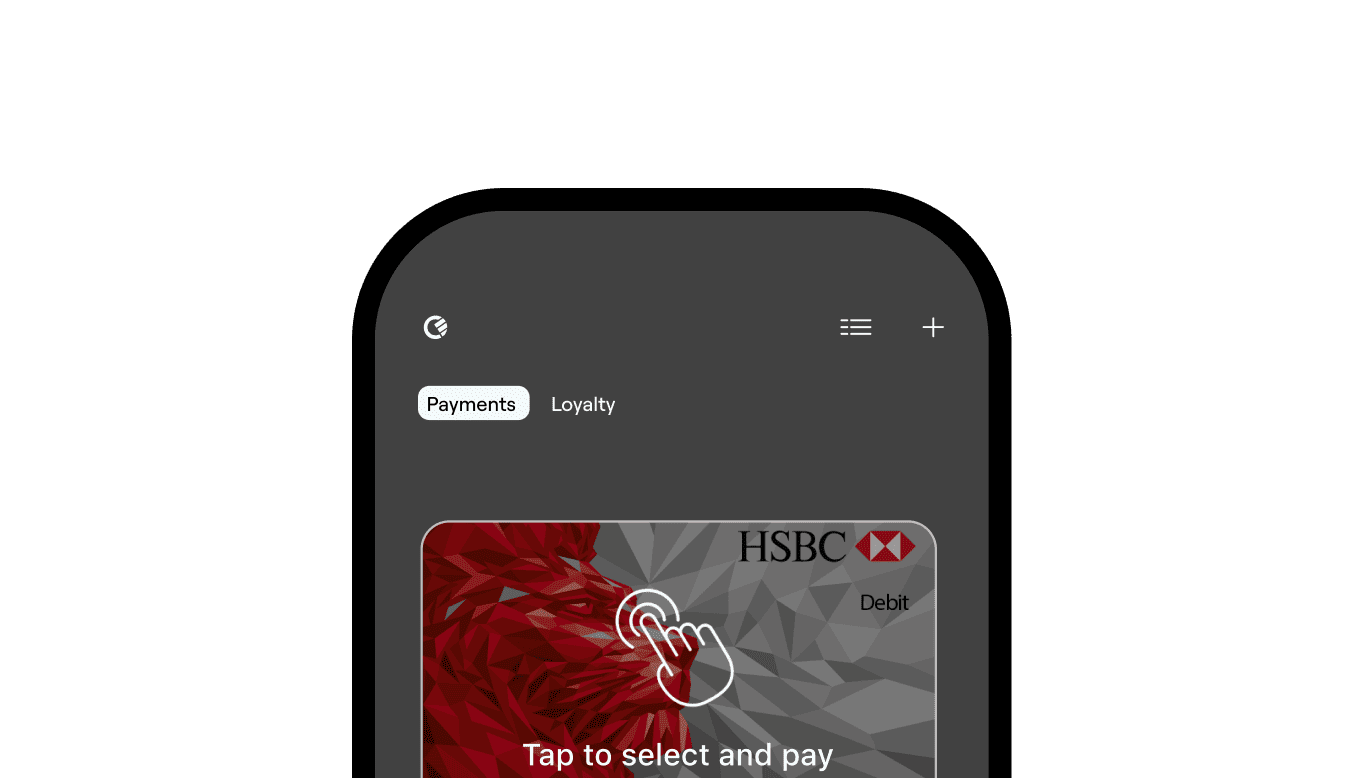

Use Your Credit Card Where It Matters Most

Some important payments — like rent, tuition or taxes — don’t usually allow credit cards. With Curve Fronted, you can. Seamlessly pay these expenses using your credit card, earn rewards, and manage cash flow with confidence.